Last updated: December 6th, 2018

Pet Insurance can be very useful to help you pay for unexpected vet bills if your dog becomes ill or is injured. One of the first questions people ask though is “how much will it cost to insure my pet dog?” The answer is – it depends on many variables. In this blog article, we illustrate what influences the cost of dog insurance policies, and what impact each factor has.

There are a number of different types of dog insurance policy available, with varying benefit limits. These can range in price from less than £100 to well over £1,000 per year depending on the level of cover you want, your address, your dog’s age, sex and breed.

We have conducted extensive research on dog insurance prices, and have obtained quotes from a number of the top pet insurance providers in the UK to help show what factors influence price the most, and give you an idea of how much you may need to pay to insure your own pet.

How Much Does Dog Insurance Cost?

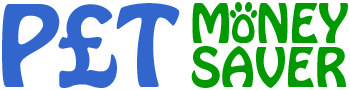

The first thing we did was obtain quotes from a number of well-known pet insurance providers for a healthy (with no prior conditions) 4 year old, female, Labrador Retriever living at an IG8 (Essex) postcode.

Quotes for requested for all levels of cover offered, and all voluntary excess options if they were available. Optional extras were not included if offered. The four main types of cover quoted for were as follows:

- Accident Only

- Time Limited

- Maximum Benefit

- Lifetime

As the name suggests, Accident Only policies only cover injuries caused by accidents, and not any illnesses, so are rather limited. Time Limited policies typically provide cover only for the 12 month period from the start of a condition, at which point that condition is excluded from future policies. Maximum Benefit policies will pay out up to a specified amount per condition with no time restriction. Lifetime cover is generally the most comprehensive, and will keep on paying for claims through your pet’s life as long as you continue to renew the policy, up to the maximum claim limit which is renewed each year.

You can read more about the differences between pet insurance policy types in our Pet Insurance Buying Guide.

After crunching some numbers, we found that while the average monthly cost for dog insurance rose steadily from £5.90 for Accident Only insurance, up to £52.84 for Lifetime cover, there was a huge difference between the cheapest and most expensive quotes for Maximum Benefit and Lifetime policies. We were also surprised to find that the most expensive quote was for a Maximum Benefit policy rather than Lifetime one, although the vet fees limit for this particular policy was relatively high at £13,000.

The steady increase in average costs is expected, as the different policy types give different levels of cover, but why were there such big differences in quotes for the same policy type? What would a £116 per month Lifetime policy give you that the £15 per month one doesn’t?

The answer to this question is because different policies can have different claim limits, and also provide a variety of benefits.

For example the vet fees limit for Lifetime policies that we checked ranged from £1,000 up to £15,000 – a huge difference. Also, some policies offer additional cover such as paying for treatment if you are abroad, dental treatment, and higher levels of third party liability cover.

Some cheaper policies also will limit the amount they will pay out per condition, within the overall vet fees limit. For example, advertising that they offer £4,000 cover but only paying £1,000 per condition.

This really proves why it’s important to work out exactly what level of cover you need, and obtain a number of quotes to find the best policy which fits your needs at an affordable price. You can use our Pet Insurance Comparison tool to compare the benefits offered by various policies, and by clicking on the Get a Quote button, it will take you directly to the provider’s website where you can obtain a quote.

Average Cost of Dog Insurance Per Year

Most policies allow you the choice of paying monthly or annually, so we’ve also calculated the average cost per year for each type of policy. For our example dog, this ranges from an annual fee of £70.82 for Accident Only insurance, all the way up to a rather hefty £634.09 for Lifetime cover. However when looking at these figures, it’s worth bearing in mind that this is still a small fraction of what you would pay if your dog suffered an injury or illness which resulted in vet fees of thousands of pounds.

The Cost of Dog Insurance by Breed

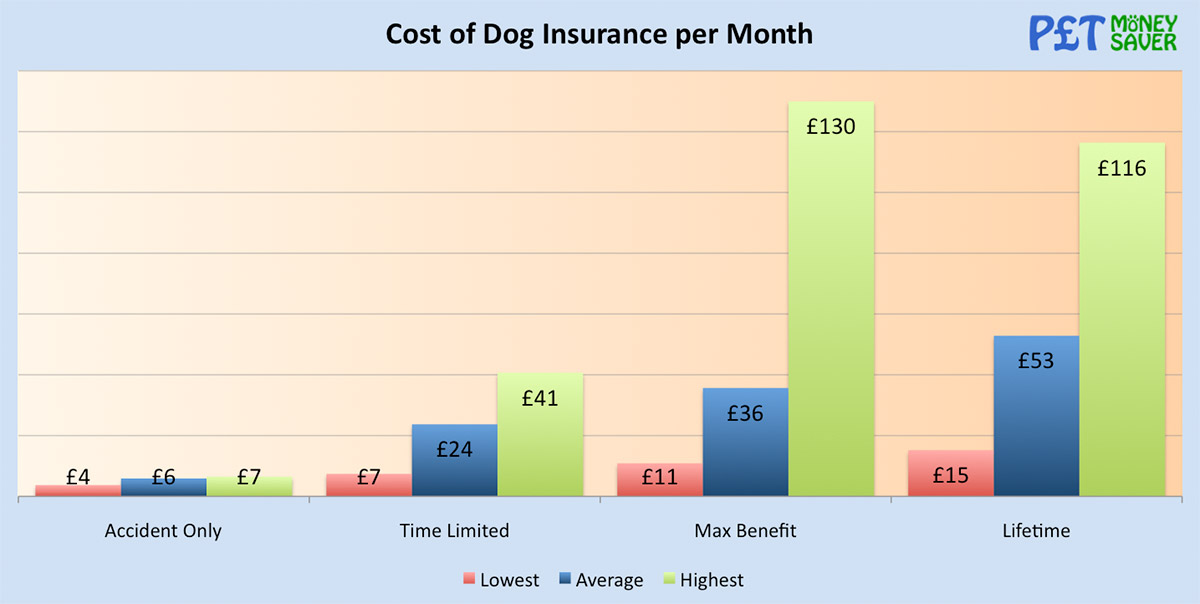

Just like a Ferrari will cost more to insure than a Mini, the breed of a dog will determine the cost to insure it. This is mostly based on whether that particular breed is prone to certain health issues which will make a claim more likely.

We obtained quotes for 11 of the most popular breeds of dog in the UK, from More Th>n Pet Insurance. The quotes were based on a 4 year old healthy dog with no previous conditions, living at an IG8 (Essex) postcode. Quotes for 4 levels of cover were obtained:

- Accident Only

- Time Limited (Basic policy with £1,500 of cover)

- Max Benefit (Classic policy with £4,000 of cover)

- Lifetime (Premier policy with £12,000 of cover)

We then did a bit more number crunching to illustrate the results below.

Accident Only quotes didn’t vary that much for most breeds, with the majority ranging between £5-8 per month. The most expensive was for the French Bulldog, and at £11.78 per month was just over twice as much as the cheapest.

French Bulldog Expensive to Insure

The price for the other types of policies varied much more. The cheapest breed of dog to insure from our research is the Yorkshire Terrier. The French Bulldog was by far the most expensive, with the same level of cover costing almost 8x more than the Yorkshire Terrier.

This is because that breed is prone to breathing difficulties, making a vet claim much more likely than other breeds. This is definitely something to bear in mind if you are looking to adopt or buy a French Bulldog. The Pug was the next most expensive breed, and again this is due to their history of breathing issues.

How Much Does Dog Insurance Vary With Age?

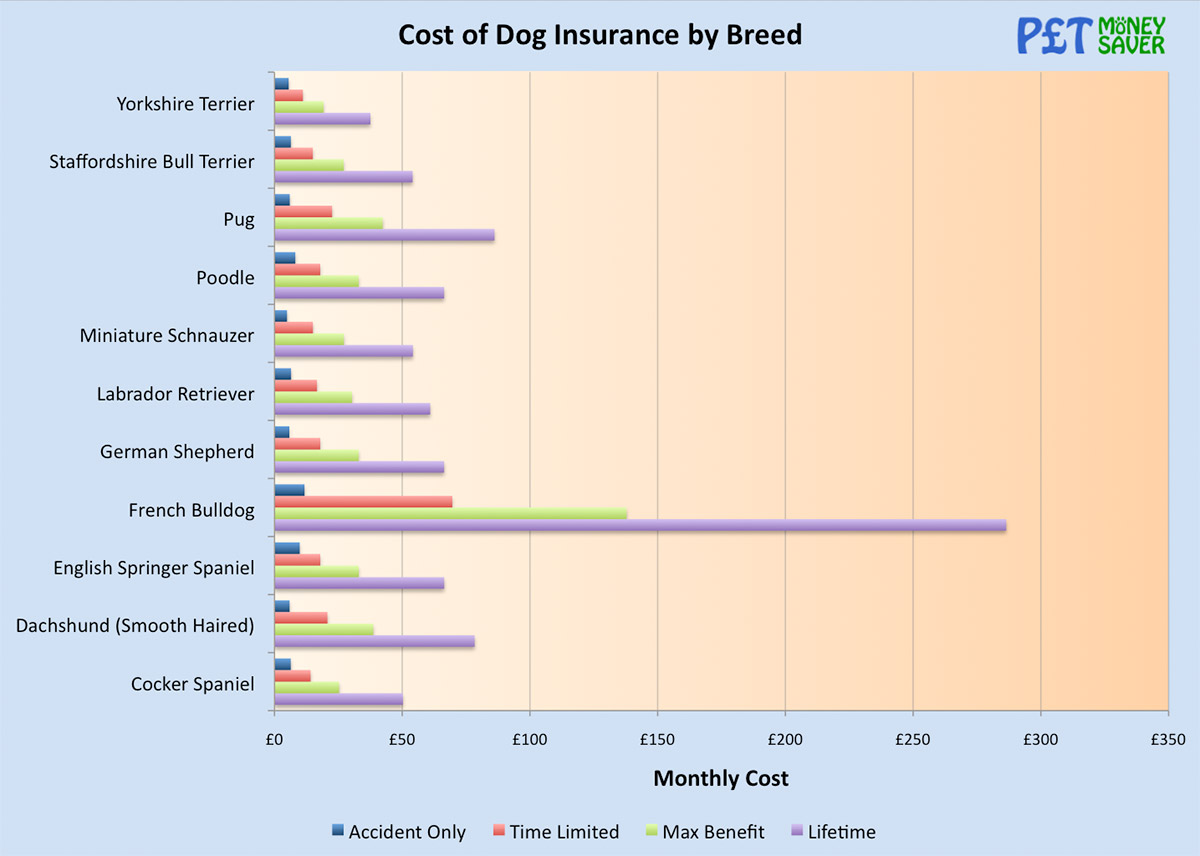

As dogs get older, they are more likely to suffer from a health condition that requires a claim and this is reflected in the premiums.

To find out how much, we obtained quotes from More Th>n Pet Insurance for a healthy Labrador Retriever with no previous conditions, living at an IG8 (Essex) postcode. Similar to the Breed comparison, quotes for 4 levels of cover were obtained:

- Accident Only

- Time Limited (Basic policy with £1,500 of cover)

- Max Benefit (Classic policy with £4,000 of cover)

- Lifetime (Premier policy with £12,000 of cover)

The quotes were all with no compulsory excess, so would be reduced if you opted to pay an additional excess when taking out the policy.

Accident Only policies didn’t increase much at all over the range from 1 to 12 years, averaging around £7 per month. The other types of policies cost around the same from 1 to 3 years with a slight decrease for a 2-year old dog, then they begin to increase year by year once the dog reaches 4 years of age.

At 12 years old, the premiums quoted for the highest level of cover were almost £250 per month, which adds up to almost £3,000 per year. This is 6x more than for a 2 year old. It’s also important to note that if you have already made a claim over the period of your dog’s life, these prices may be even higher.

It’s also worth noting that some providers charge a higher excess amount for older dogs. In the case of More Th>n, you will pay a compulsory excess of 20% if your dog is 9 or older, in addition to the fixed excess. It’s also worth noting that some providers will not cover pets once they reach a certain age, so your options for shopping around are reduced. Our comparison tool will help you find policies for older dogs.

To reduce these costs, you can look at opting for a lower level of cover – for example the Max Benefit policy is less than half the cost of the Lifetime one.

Other Factors that Influence the Cost of Dog Insurance

The sex of your dog can affect the cost of insuring them, although the differences are not huge.

Based on quotes from More Th>n for a 4 year old Labrador, a male dog will cost around 6-7% more to insure than a female.

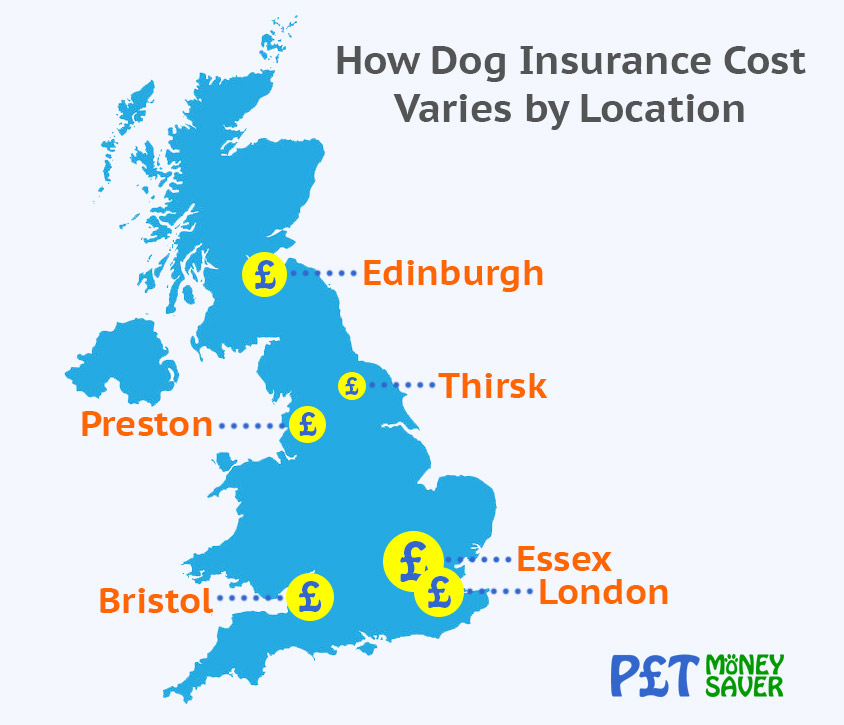

Your address can also affect the price. One reason for this is that outside London vet fees are generally cheaper, which is reflected in lower premiums. The graphic below illustrates the difference in the average cost of insuring a 4 year old Labrador Retriever.

We obtained quotes for 6 different postcodes from Bristol to Edinburgh, and the most expensive (Essex) was just over double that of the cheapest (Thirsk, Yorkshire). Random fact – the vet and writer James Herriot was based in Thirsk – although it’s unlikely that this is the reason Thirsk has the cheapest pet insurance prices of all the locations we checked.

Preston was the next cheapest location, at just over 50% of the cost of the most expensive region, and Edinburgh quotes were 70%. London and Bristol were slightly more expensive, but still less than 80% of the highest quotes we obtained.

Please note that all figures in this article are based on quotes obtained for our own research, and are solely meant as information only. We do not advise which product you should buy, and you should undertake your own due diligence before taking out any pet insurance policy.

Quotes were obtained in September 2018 from the following providers: Argos Pet Insurance, Pet Plan, John Lewis, More Th>n, Animal Friends, Co-Op, EandL, M&S, Bought by Many, Scratch & Patch and Sainsbury’s.