Last updated: December 6th, 2018

Pet Insurance can be very useful to help you pay for unexpected vet bills if your cat becomes sick or is injured. One of the first questions people ask though is “how much will it cost to insure my pet cat?” The answer isn’t straightforward however, and really depends on many variables. In this article, we examine what influences the cost of cat insurance policies, and what impact each factor has.

There are a number of different types of cat insurance policy available, with varying benefit limits. These can range in price from less than £50 to several £100s per year depending on the level of cover you want, your address, your cat’s age, sex and breed.

We have conducted extensive research on cat insurance prices, and have obtained quotes from a number of the top pet insurance providers in the UK to help show what factors influence price the most, and give you an idea of how much you may need to pay to insure your own pet.

How Much Does Cat Insurance Cost?

The first thing we did was obtain quotes from a number of well-known pet insurance providers for a healthy (with no prior conditions) 4 year old, female, non-pedigree Moggy living at an IG8 (Essex) postcode.

Quotes for requested for all levels of cover offered, and all voluntary excess options if they were available. Optional extras were not included if offered. The four main types of cover quoted for were as follows:

- Accident Only

- Time Limited

- Maximum Benefit

- Lifetime

As the name suggests, Accident Only policies only cover injuries caused by accidents, and not any illnesses, so are rather limited. Time Limited policies typically provide cover only for the 12 month period from the start of a condition, at which point that condition is excluded from future policies. Maximum Benefit policies will pay out up to a specified amount per condition with no time restriction. Lifetime cover is generally the most comprehensive, and will keep on paying for claims through your pet’s life as long as you continue to renew the policy, up to the maximum claim limit which is renewed each year.

You can read more about the differences between pet insurance policy types in our Pet Insurance Buying Guide.

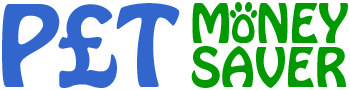

After crunching some numbers, we found that the average monthly cost for cat insurance rose steadily from just £3 for Accident Only insurance, up to £16 for Lifetime cover. Compared to dog insurance, there wasn’t such a big difference between the cheapest and most expensive quotes for Maximum Benefit and Lifetime policies.

It’s also interesting to note that the average cost for cat insurance is much less than for dog insurance.

The steady increase in average costs is expected, as the different policy types give different levels of cover, but why were there such big differences in quotes for the same policy type? What would a £31 per month Lifetime policy give you that the £7 per month policy doesn’t?

The answer to this question is because different policies can have different claim limits, and also provide a variety of benefits.

For example the vet fees limit for Lifetime policies that we checked ranged from £1,000 up to £15,000 – a large difference. Also, some policies offer additional cover such as paying for treatment if you are abroad on holiday, dental treatment, and higher levels of third party liability cover.

Some cheaper policies also will limit the amount they will pay out per condition, within the overall vet fees limit. For example, advertising that they offer £4,000 cover but only paying £1,000 per condition.

This just shows why it’s important to work out exactly what level of cover you need, and obtain a number of quotes to find the best policy which fits your needs at an affordable price. You can use our Pet Insurance Comparison tool to compare the benefits offered by various policies, and by clicking on the Get a Quote button, it will take you directly to the provider’s website where you can obtain a quote.

Average Cost of Cat Insurance Per Year

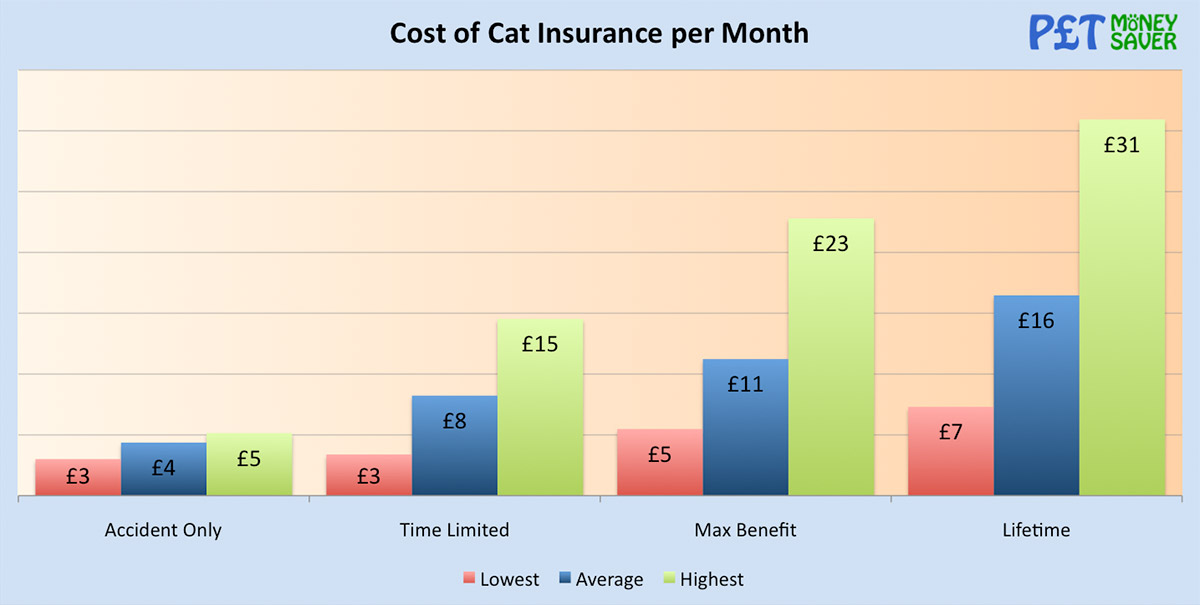

Most policies allow you the choice of paying monthly or annually, so we’ve also calculated the average cost per year for each type of policy. For our example cat, this ranges from an annual fee of £52.39 for Accident Only insurance, all the way up to £197.66 for Lifetime cover. However when looking at these figures, it’s worth bearing in mind that this is still a small fraction of what you would pay if your cat suffered an injury or illness which resulted in vet fees of thousands of pounds.

The Cost of Cat Insurance by Breed

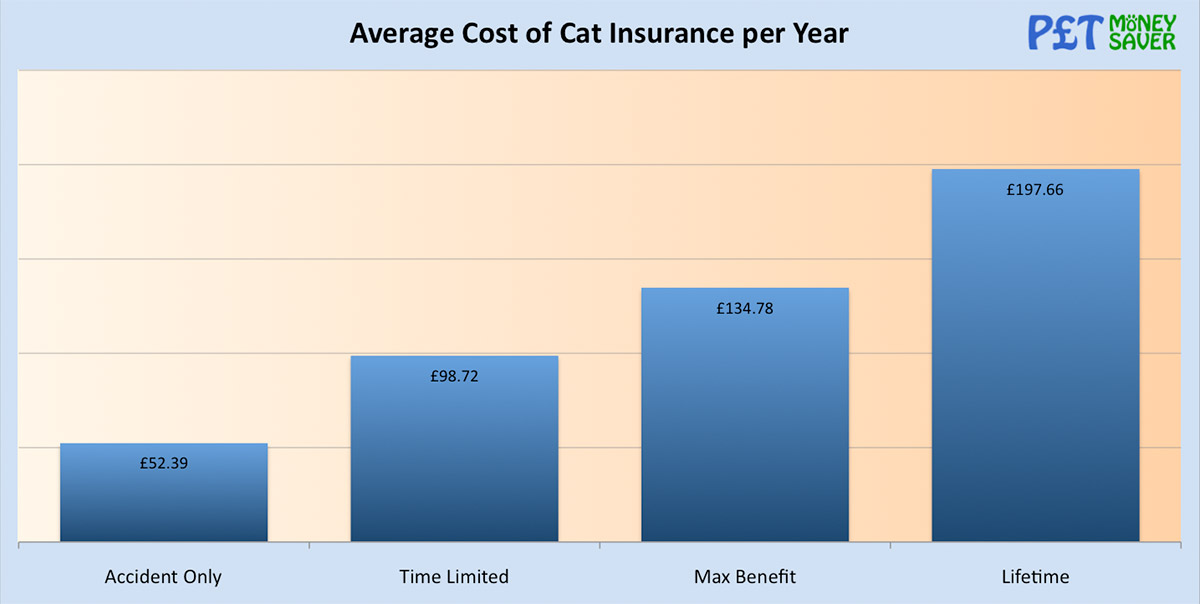

Unlike dogs, where the breed can make a big difference to the cost of insurance, there is much less variance for cats.

We obtained quotes for 12 of the most popular breeds of cat in the UK, from More Th>n Pet Insurance. The quotes were based on a 4 year old healthy cat with no previous conditions, living at an IG8 (Essex) postcode. Quotes for 4 levels of cover were obtained:

- Accident Only

- Time Limited (Basic policy with £1,500 of cover)

- Max Benefit (Classic policy with £4,000 of cover)

- Lifetime (Premier policy with £12,000 of cover)

We then did a bit more number crunching to illustrate the results below.

Accident Only quotes were almost exactly the same for all breeds.

The prices for other policy types varied more, but not to the same scale compared to dog insurance quotes. The most expensive breed was less than 2x the cost of the cheapest, compared to an 8x difference between the cheapest and most expensive dog breeds.

One reason for this is that by and large, not many cat breeds are prone to expensive-to-treat conditions specific to that breed. There are a couple of exceptions though, for example Maine Coons can require more expensive treatment due to their large size making it more likely that they will suffer from hip dysplasia.

It’s also interesting to note that non-pedigree cats are the cheapest to insure – another good reason for adopting from a rescue centre, rather than buying a pedigree breed. You’ll be doing a good deed, and saving money too!

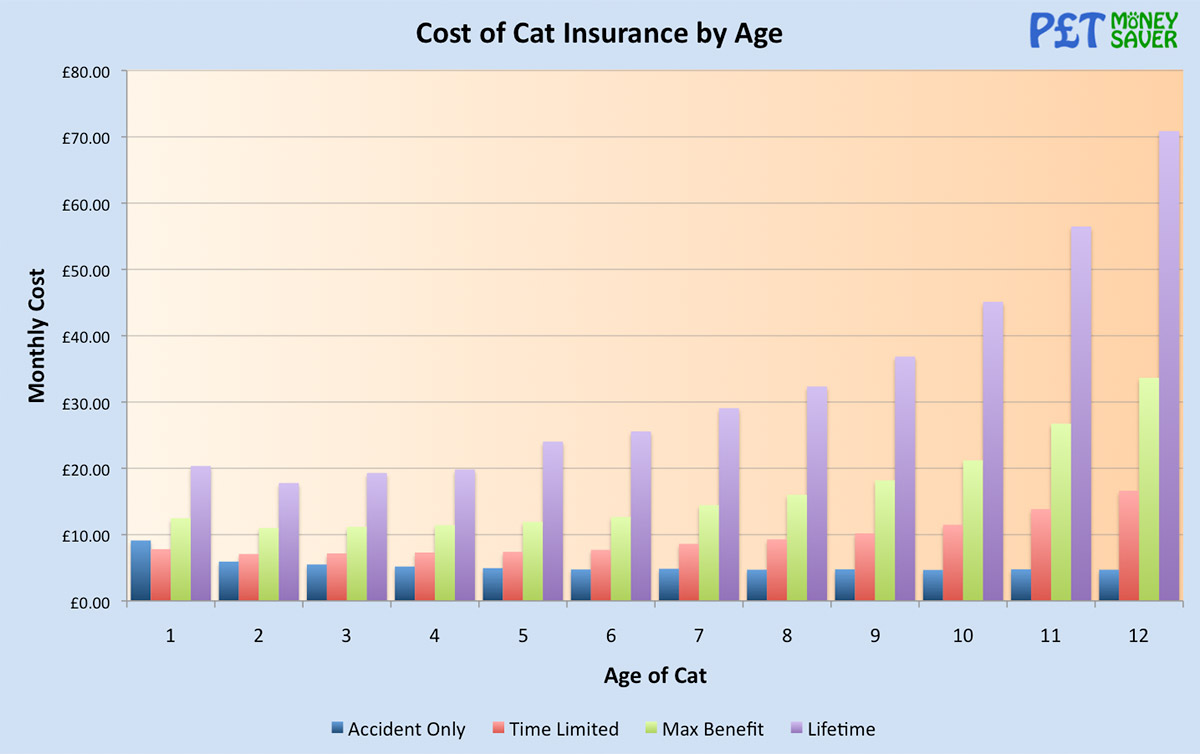

How Much Does Cat Insurance Vary With Age?

As cats get older, they are more likely to suffer from a health condition that requires a claim, and this is reflected in the premiums.

To find out how much, we obtained quotes from More Th>n Pet Insurance for a healthy non-pedigree Moggy with no previous conditions, living at an IG8 (Essex) postcode. Similar to the Breed comparison, quotes for 4 levels of cover were obtained:

- Accident Only

- Time Limited (Basic policy with £1,500 of cover)

- Max Benefit (Classic policy with £4,000 of cover)

- Lifetime (Premier policy with £12,000 of cover)

The quotes were all with no compulsory excess, so would be reduced if you opted to pay an additional excess when taking out the policy.

Accident Only policies are more expensive for a 1 year old cat than for older cats, and after 5 years old stay at a similar level. This implies that young cats are more prone to getting themselves hurt in an accident, but once they reach 2-3 years old, their age doesn’t make any difference to their potential vet bills.

The other types of policy become more expensive with age once the cat reaches 4-6 years old. Both Time Limited and Maximum Benefit policies stay fairly level until the cat reaches 5 or 6 years of age. However Lifetime policies start to increase a year or two earlier.

After the age of 7 or 8, the policy costs start to increase more. For a Lifetime policy, the cost to insure a 12 year old cat is nearly 4 times that of the cost of insuring a younger cat.

It’s also worth noting that some providers charge a higher excess amount for older cats. In the case of More Th>n, you will pay a compulsory excess of 20% if your cat is 9 or older, in addition to the fixed excess. It’s also worth noting that some providers will not cover pets once they reach a certain age, so your options for shopping around are reduced. Our comparison tool will help you find policies for older cats.

To reduce these costs, you can look at opting for a lower level of cover – for example the Max Benefit policy is less than half the cost of the Lifetime one.

Other Factors that Influence the Cost of Cat Insurance

The sex of your cat can affect the cost of insuring them, although unlike dogs, the differences can be significant. One reason for this is that male cats are more prone to Urinary Tract Infections as they have a narrower urethra than a female cat.

Based on quotes from More Th>n for a 4 year old non-pedigree Moggy, a male cat will cost around 30-40% more to insure than a female.

Your address can also affect the price. One reason for this is that outside London vet fees are generally cheaper, which is reflected in lower premiums. The graphic below illustrates the difference in the average cost of insuring a 4 year old non-pedigree Moggy.

We obtained quotes for 6 different postcodes from Bristol to Edinburgh, and the most expensive (Essex) was just under double that of the cheapest (Thirsk, Yorkshire). Random fact – the vet and writer James Herriot was based in Thirsk – although it’s unlikely that this is the reason Thirsk has the cheapest pet insurance prices of all the locations we checked.

Preston was the next cheapest location, at 56% of the cost of the most expensive region, and Edinburgh quotes were just over 70%. London and Bristol were slightly more expensive, but still less than 80% of the highest quotes we obtained.

We also obtained quotes to see if neutering or fitting a micro-chip affected the price, and we found that it didn’t. The same was also true for indoor/outdoor cats which is surprising, as it would be reasonable to expect an outdoor cat to be more prone to getting injured than a house cat. However the quotes we obtained showed no difference in cost.

Please note that all figures in this article are based on quotes obtained for our own research, and are solely meant as information only. We do not advise which product you should buy, and you should undertake your own due diligence before taking out any pet insurance policy.

Quotes were obtained in September and November 2018 from the following providers: Argos Pet Insurance, Pet Plan, John Lewis, More Th>n, Animal Friends, Co-Op, EandL, M&S, Bought by Many, Scratch & Patch and Sainsbury’s.