Buying pet insurance for your cat or dog can be a large investment. With so many different providers and policies available, how do you know which pet insurance policy gives the best value?

We have done some research to help answer this question, and hopefully give you a better idea of what to look for. In this blog, we look at the best value Time Limited, Max Benefit and Lifetime policies for cats and dogs.

As part of this research, we obtained almost 200 quotes from 11 of the best pet insurance providers in the UK. We received quotes for 3 types of pet insurance:

- Time Limited

- Maximum Benefit

- Lifetime

You can read more about the differences between pet insurance policy types in our Pet Insurance Buying Guide.

Quotes were requested for the following two pets, living at an Essex (IG8) postcode:

Dog

- Age: 4 years old

- Breed: Labrador Retriever

- Sex: Female

- Other options: Neutered and chipped/tagged

Cat

- Age: 4 years old

- Breed: Moggy

- Sex: Female

- Other options: Neutered and outdoor

This resulted in a large amount of data, so we then spent some time crunching the numbers, and putting together some charts to illustrate our findings.

What the Value Rating Means

Each policy is given a score out of 100, which is our own calculation based on the level of cover available, and the cost of the policy. When a policy has various excess options, these quotes were averaged out to simplify the results.

Two value figures are calculated for each policy. One for simply buying the policy, and another taking into account any excess that would be paid if you made a single claim for £1,000. The reason for this is to identify policies that may seem good value initially, but actually give less value due to higher excess amounts.

The higher the number, the more vet fees cover you get for every £ you spend – i.e., higher = better. This however is only valid if you claim for the whole amount you have cover for. It is possible to pay for too much cover that you may never need, which may be a waste of money.

For example, the following two policies would have the same value rating:

Policy A

- Vet fees cover = £3,000

- Yearly cost = £100

- Cover per £1 you pay = £30

Policy B

- Vet fees cover = £4,500

- Yearly cost = £140

- Cover per £1 you pay = £32.14

Policy B gives slightly better value, as you get £32.14 of cover for every £1 you pay. However if you didn’t need to claim more than £3,000 then you’d be paying more money for cover you don’t need with Policy B.

How the Excess Affects Value

The excess amount will affect the value, depending on how much the excess is. If we now look at a third example – Policy C

Policy C

- Vet fees limit = £3,000

- Yearly cost = £200

- Cover per £1 you pay = £15

Using the examples above, at first glance Policy A gives twice as much cover for your money than Policy C. However, it is possible that Policy C actually gives better value overall than Policy A when you make a claim if you pay a smaller excess. For example if you made a claim for £1,000 you may pay the excess as follows:

Policy A

- Excess: Fixed £100 + voluntary excess (20% of £900) = £290

- Total cost of policy: £100 + £290 = £390

- Cover per £1 you pay = £7.69

Policy C

- Excess: Fixed £100

- Total cost = £300

- Cover per £1 you pay = £10

When you take the excess cost into account, Policy C actually is better value – despite it’s higher initial cost.

Average Vet Fees Cover

Using the data we collected, we calculated the average vet fees cover provided by the 3 different types of policy.

- Time Limited: £3,300

- Max Benefit: £5,500

- Lifetime: £7,100

This should give you some idea of the typical amount of cover available for each type of policy.

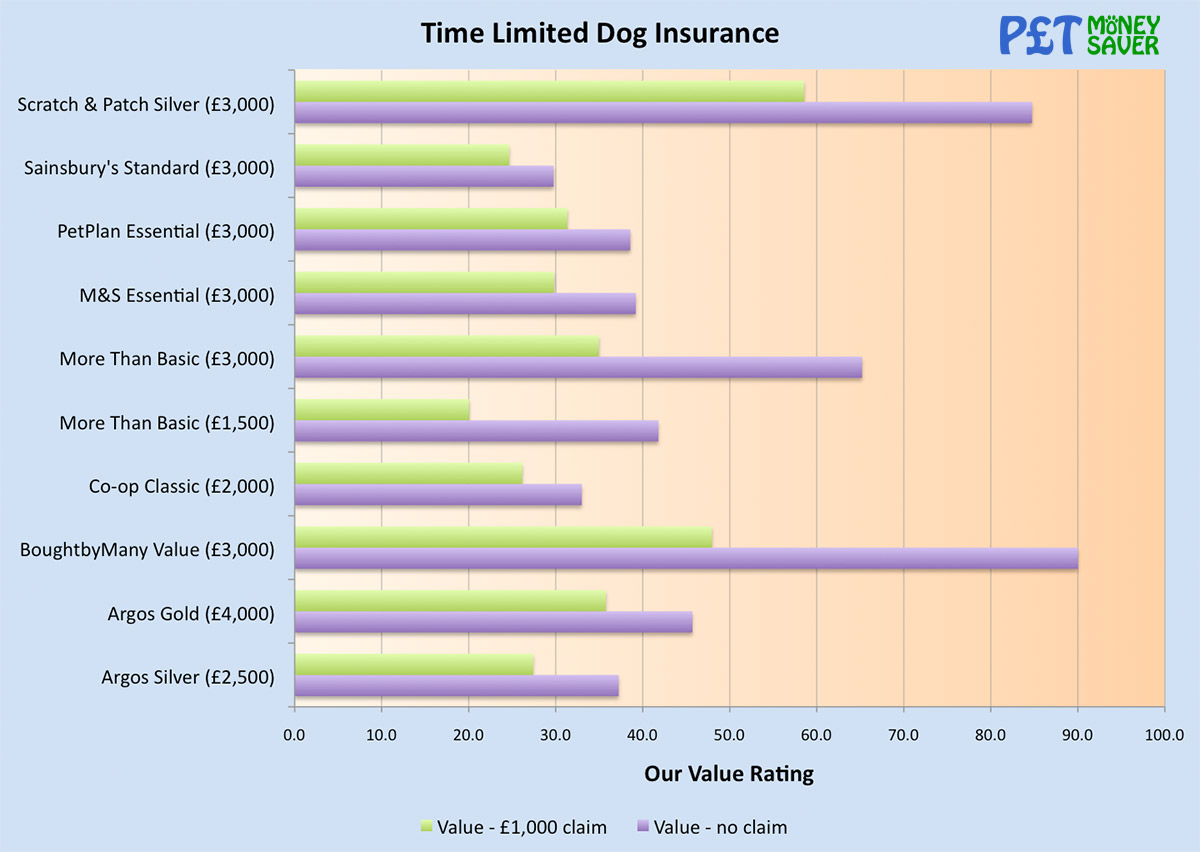

Best Value Time Limited Dog Insurance

Looking at the chart below, our research shows a few things. Firstly, in general, when a provider offers policies with different claim limits, the higher one is better value. For example the More Than Basic policy with £3,000 cover gives better value than their £1,500 policy.

Another interesting point is that some policies have very similar value scores for both the no-claim and £1,000 claim scores. This is because they have a relatively small excess. Usually, the policies with a big difference in scores (for example the BoughtbyMany Value and More Than Basic policies) have a larger excess – usually because they have an option to charge a voluntary excess which includes a percentage (up to 20%) of the claim amount. This can make the excess fee rather expensive if you need to make a large claim.

Based on our results, the policies with the best value scores are Scratch & Patch Silver, and BoughtbyMany Value – both provide £3,000 of cover. The More Than Basic (£3,000) policy also gives good value, but if you need to make a claim it’s advantage isn’t quite as much.

The policies that have the worst value scores are the two that offer the lowest amount of vet fees cover. Therefore unless you are very confident that you won’t be needing the higher level of cover, you may feel it is worth paying a relatively small amount extra for more peace of mind.

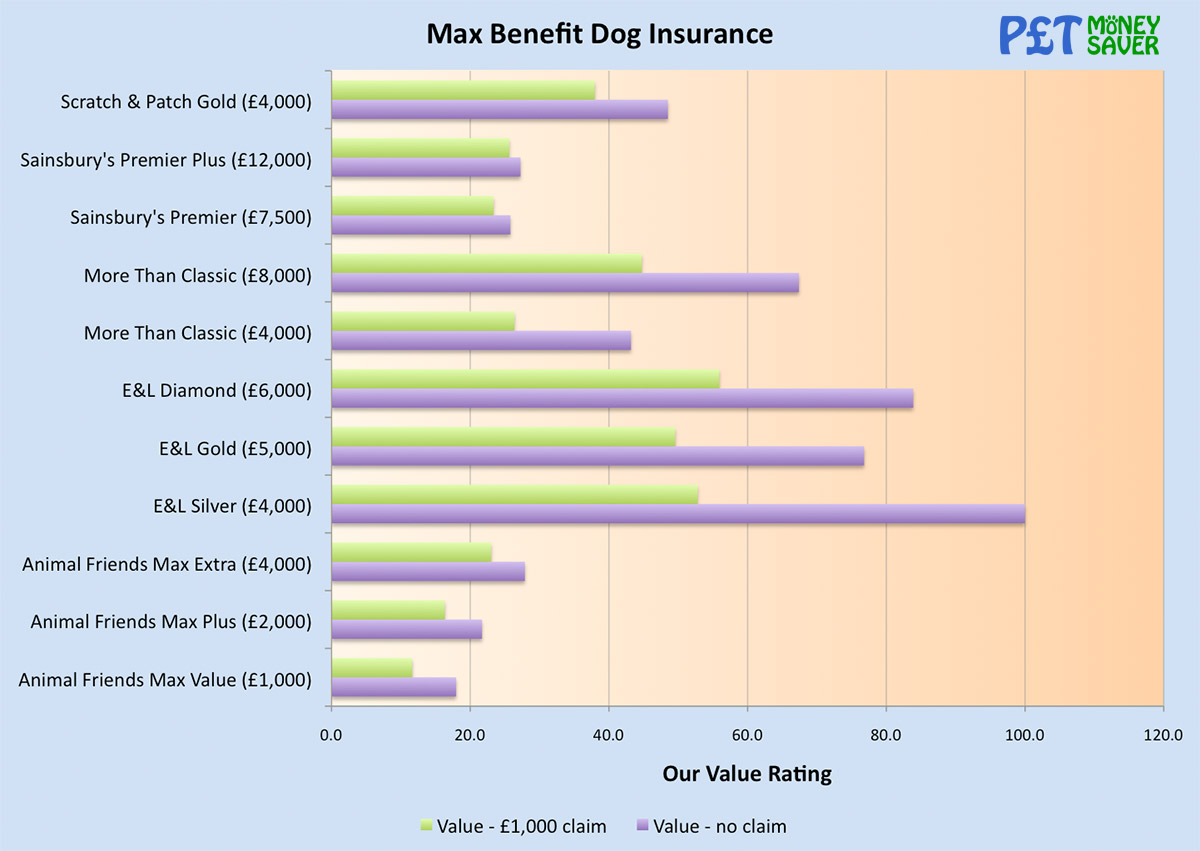

Best Value Maximum Benefit Dog Insurance

Next we looked at the best value Maximum Benefit dog insurance quotes. The first thing that is noticeable is that the three E&L policies score the highest, with their Diamond policy giving the best value of the three.

Next up is the More Than Classic policy with £8,000 of cover, followed closely by the the Scratch & Patch Gold policy.

As with the Time Limited policies, the lowest value scores are from the policies with the lowest amount of vet fees cover. Although they offer the lowest about of cover, they were not the cheapest policies in the quotes we obtained.

Another interesting comparison is looking at the two Sainsbury’s policies and the two More Than policies. You get very similar value scores with the two Sainsbury’s policies, however the higher-rated More Than Classic policy with £8,000 of cover is noticably better value than the the similar policy with £4,000 of cover.

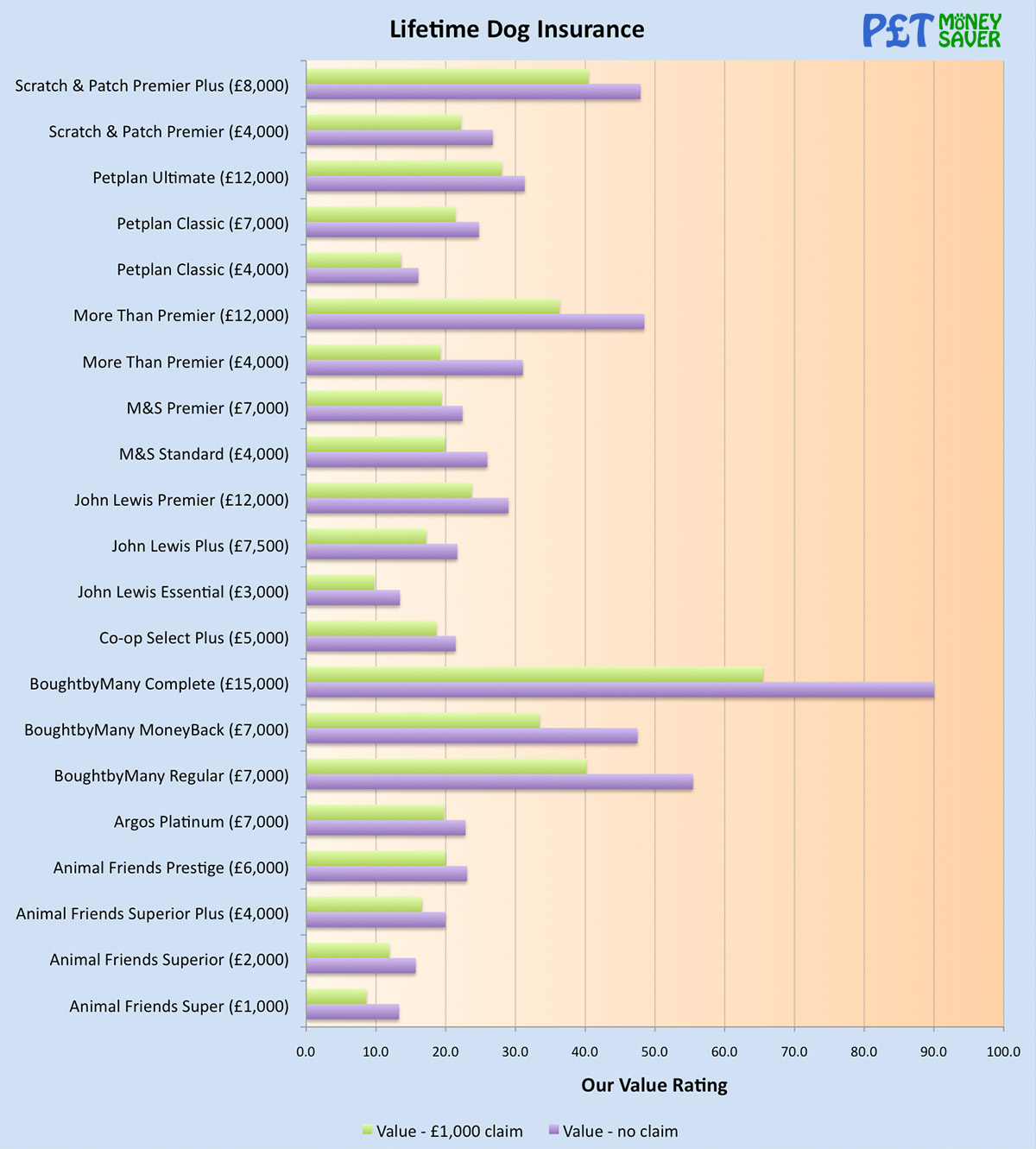

Best Value Lifetime Dog Insurance

The majority of Lifetime Dog Insurance policies give similar value scores, with a few notable exceptions.

The three BoughtbyMany policies give excellent scores, with 2 of their policies obtaining the top two highest value scores. The Scratch & Patch Premier Plus and More Than Premier policies also scored very highly, with the Scratch & Patch policy just nudging ahead due to the slightly lower excess charges.

Another notable mention is for the Petplan Ultimate policy, which scores well in the £1,000 claim value due to it’s comparatively low excess.

There is a much wider range of vet fees cover with Lifetime policies – these range from £1,000 up to £15,000. As such, the cost also can vary considerably, so it’s important to decide what level of cover you really need.

Thus although the policies with the highest cover (BoughtbyMany Complete and More Than Premier) have high value scores, this doesn’t necessarily mean they would be the best choice if you didn’t need the full amount of cover.

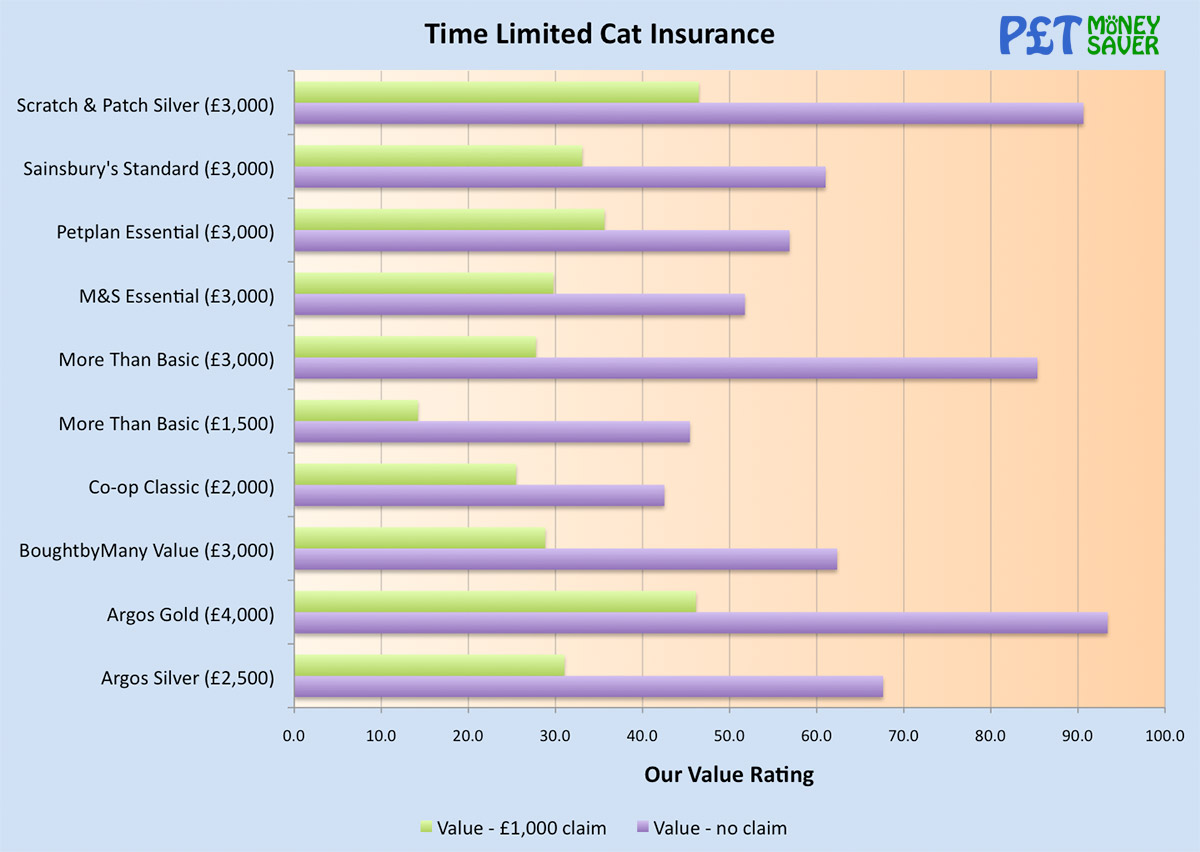

Best Value Time Limited Cat Insurance

Now we look at the Time Limited cat insurance policies. What’s interesting is that there is a much greater difference between the value scores for no claims and £1,000 claim than dog insurance quotes. This is because cat insurance premiums are considerably lower than those for dog insurance – however the excess charges are the same. Therefore an excess of say £100 makes much more of a difference in percentage terms.

This also means that policies with a voluntary % excess end up costing more than those with a fixed excess. For example the More Than Basic (£3,000) policy has the second highest value score with no claim, but the third lowest score when you take into account the excess.

With that in mind, the Argos Gold and Scratch & Patch Silver policies have two of the highest value scores. The Petplan Essential policy also scores highly.

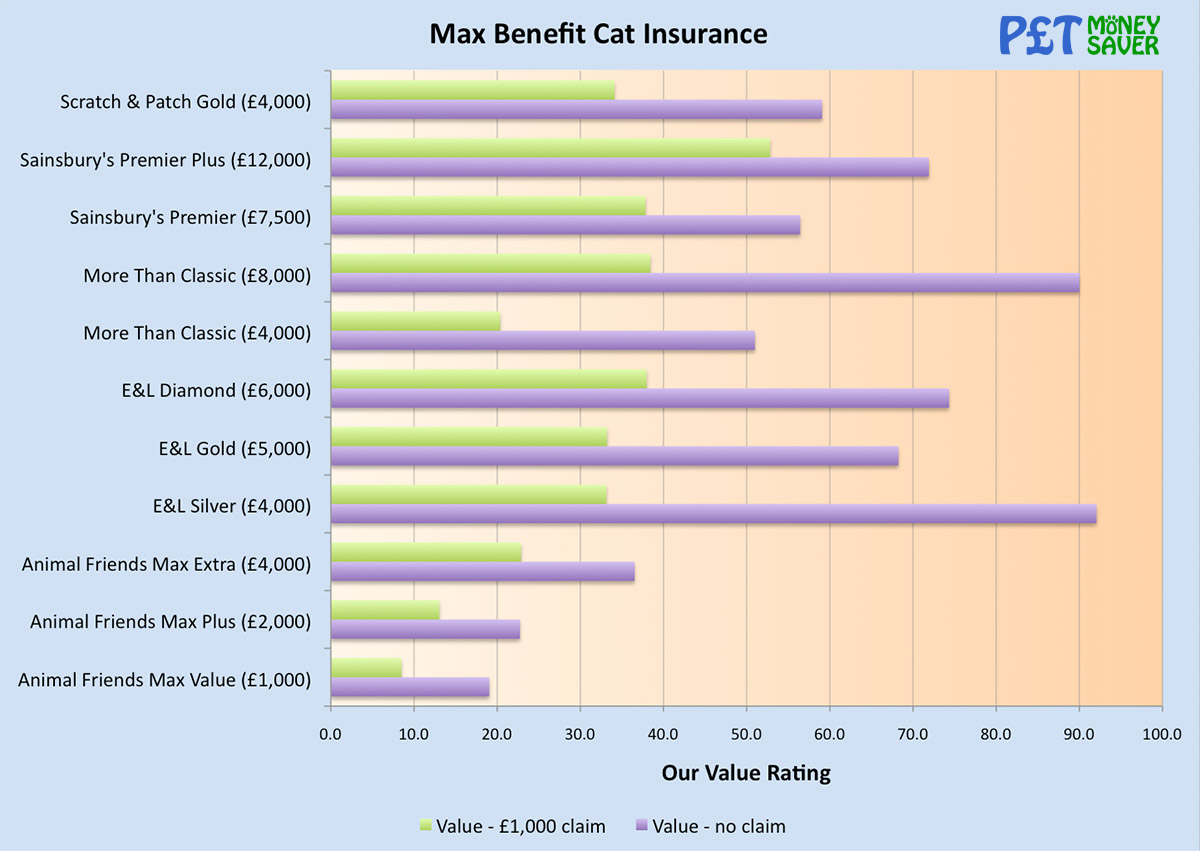

Best Value Maximum Benefit Cat Insurance

Similar to the Time Limited cat insurance results, there are big differences between the no claim and £1,000 claim scores for some policies. This is again due to the excess amount making up a large proportion of the cost if you make a claim. This is definitely something to bear in mind when taking out a policy. For example the E&L policies have high value scores initially, however their relatively high excess amounts reduce the scores if you make a claim. Even so, their Diamond policy still has a good value score.

The Sainsbury’s Premier Plus policy gets a high score due to the very high vet fees limit and relatively low excess – but this may not be such good value if you don’t need the full £12,000 amount of cover. If that’s the case, then their Premier policy would be worth looking at.

The More Than Classic (£8,000) policy scores well again, as it does for dog insurance. This makes it a good option to look at if you want to insure both cats and dogs on the same policy.

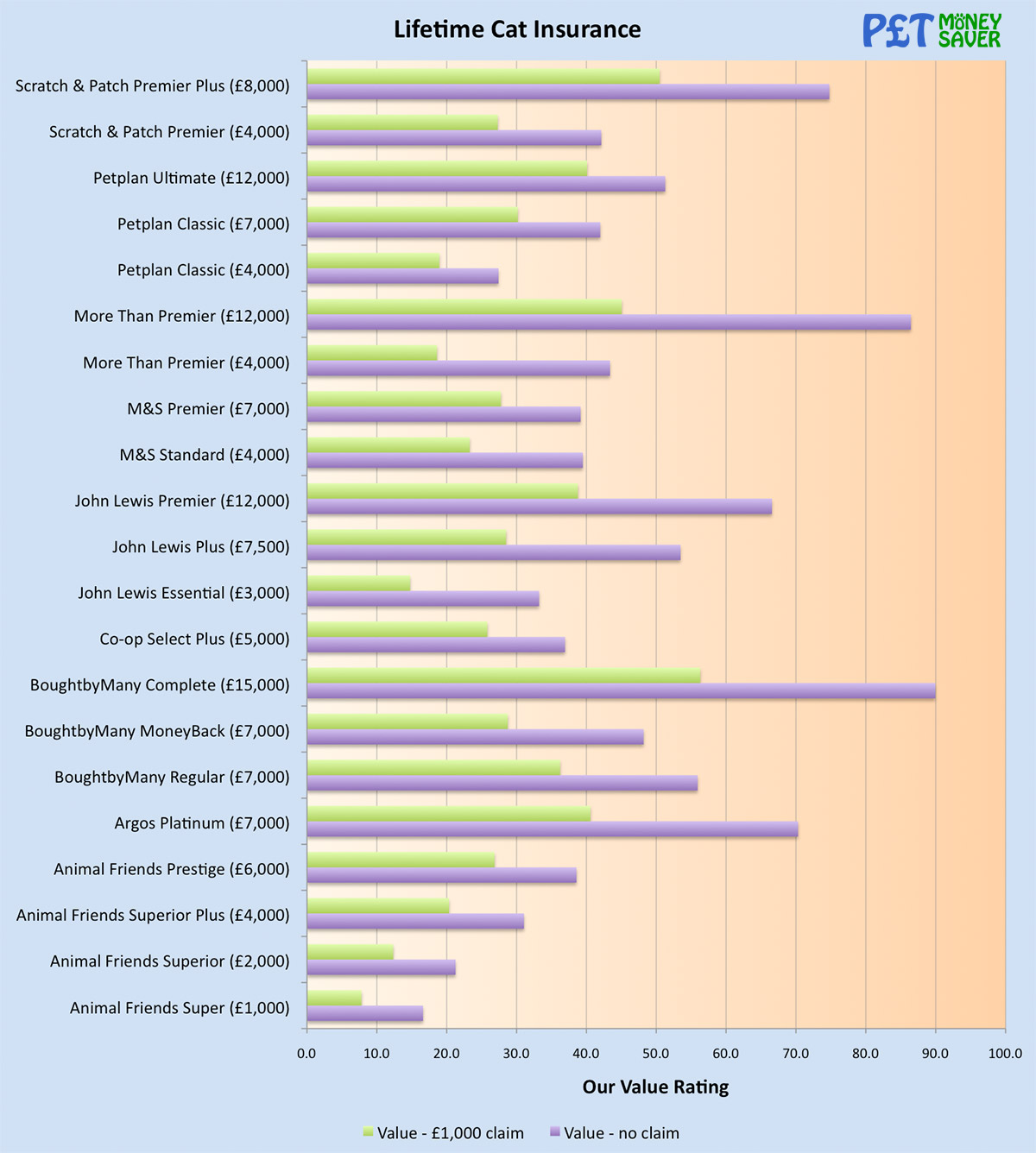

Best Value Lifetime Cat Insurance

As with the Lifetime dog insurance quotes, there is a very wide range of vet fees limits for Lifetime cat insurance. This means you really need to decide what level of cover you need first, as although the policies with the most cover get the highest value scores, you may not actually need the full amount.

As with the Lifetime dog insurance quotes, the BoughtbyMany Complete, More Than Premier (£12,000) and Scratch & Patch Premier Plus policies get the highest value scores.

The Petplan Ultimate, Argos Platinum and John Lewis Premier policies are also well worth looking at too.

Value is Only One Factor

While these value scores are a good guide to how much cover you get for your money, it is only one factor. There are several other important factors to look at before you decide which policy to buy, for example:

What cover does the policy offer

The amount of vet fees that a policy will pay is just one aspect of a policy. Some policies will cover your pet while you travel abroad, offer dental cover or will cover older pets.

Who provides the cover

Usually, the policy is underwritten by a different company. For example Co-op policies are provided by Allianz Insurance – one of the largest insurance companies in the world, and Argos policies are provided by RSA – the second largest insurance company in the UK. So if you have a preference for a particular insurer based on other reviews or previous experience, this is something to bear in mind.

Price increases due to claims or age

Just like car insurance, many pet insurance providers will increase your renewal cost if you make a claim. The big difference with car insurance though is that once you claim for a condition for your pet, you’re usually tied in to staying with your current insurer – so are stuck with their price increases. This is because most policies won’t cover pre-existing conditions – although a small number of policies will do, for example BoughtbyMany Existing Conditions.

Petplan state that they won’t increase your premiums if you make a claim, so in the long term they may end up being better value.

Also, premiums will naturally increase as your pet gets older, but the differences may vary between providers.

You can compare pet insurance policies from different providers on our Pet Insurance Comparison page.

Quotes were obtained in September 2018, from the following Providers: Animal Friends, Argos, BoughtbyMany, Co-op, E&L, John Lewis, More Than, M&S, Petplan, Sainsbury’s and Scratch & Patch.

Disclaimer

While this blog is intended to help you in your search to find the best pet insurance policy, it is for information only and should not solely be relied upon. Pet insurance costs can depend on a combination of factors including your address, the breed and age of your pet. Different policies also offer varying levels of cover. As such, it’s important for you to undertake your own due diligence before you buy a policy.